This article analyzes how information warfare and narrative reputation have become vital issues for corporate survival. Jérôme Denariez explains that public image—shaped on social media and forums—can now take precedence over the reality of accounting balance sheets. Executives, and particularly Chief Financial Officers (CFOs), must master this narrative to maintain the trust of investors and bankers in the face of toxic rumors. The author advocates for the use of tools such as OSINT and economic intelligence to anticipate informational crises. In conclusion, modern governance is no longer limited to managing numbers but extends to the strategic protection of the organization’s digital identity. (Ed. Note)

Table of Contents

by Jérôme Denariez — Paris, December 29, 2025

OSINT, field intelligence, and financial decisions: when storytelling overrides accounting

(Editor’s Note: With this article, Jérôme Denariez inaugurates a series of columns on the overlooked intersection between corporate finance and economic intelligence. Or how the « narrative » has become an asset – or a liability – as tangible as cash flow.)

Executives often think in terms of numbers, contracts, and compliance. They are right. But in an environment saturated with information, that is no longer enough.

A company can present certified accounts, a viable business model, and an orderly organization, yet find itself weakened by a different reality. The one circulating outside the files. The one built in networks, on forums, in the local press, and in conversations on the ground.

Jérome Denariez — Photo © All Rights Reserved

Based on real-life experiences in a listed SME, this article shows how the narrative becomes a financial risk in its own right, and why controlling this narrative is now fully a matter of governance and economic intelligence.

When « Parallel Reality » Takes Power

Leaders are often told that there is no point in approaching a bank or a fund if the books aren’t clean. That is true. And yet, it is no longer enough.

I understood early on that a company can have certified accounts, a business model that still stands, and teams doing the work, and despite all that, wake up one morning with a different story already circulating.

- A story written elsewhere. Picked up elsewhere. Commented on elsewhere.

It doesn’t come from the numbers. It doesn’t come from the board minutes. It comes from forums, media, social networks, the local territory, the field. It comes from details no one deems important at the time. And it is that story which ends up weighing on banks, investors, talent, and sometimes even clients.

The real question is no longer just whether the accounts are good. It becomes tougher: Who is writing my company’s story in my place?

Trial by Fire: When a Stock Forum Decides the Future

In a previous life, I managed the IPO of a regional B2C services group, first as an auditor, then as CFO. For the region, it was a small earthquake. A source of local pride. Inside, we felt like we were entering the big leagues: certified accounts, reinforced processes, a growth narrative.

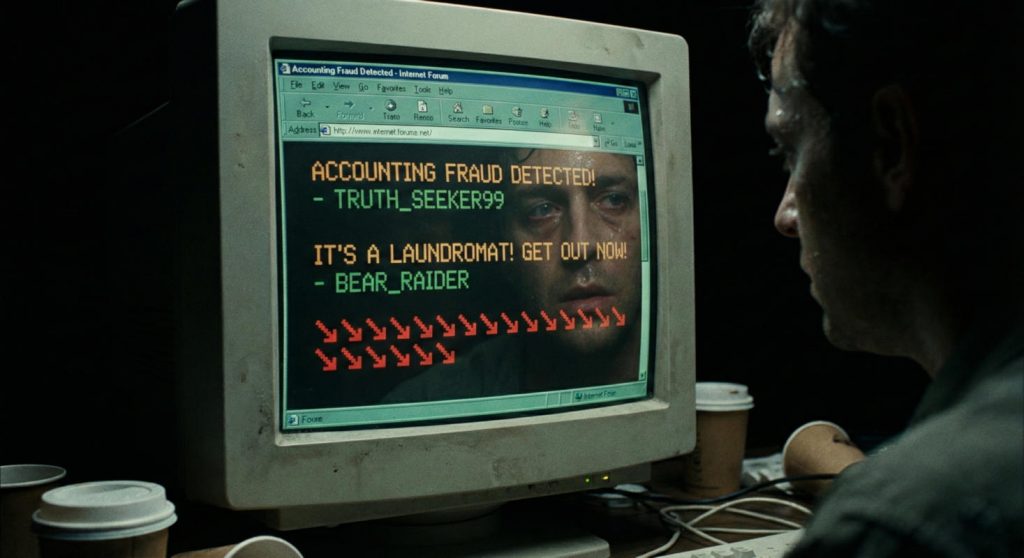

Then the market started talking somewhere other than in our board meetings. On a major stock trading forum, anonymous users posted message after message, accusing the group of cooking the books, talking about a « laundromat. » In the local microcosm, these rumors mixed with the usual baggage of a service company: a disgruntled client, a misunderstood dispute, a jealous competitor, a taste for scandal.

The disconnect was total:

- On one side: a legal and accounting reality documented by auditors and lawyers.

- On the other: a narrative reality manufactured by multiple actors, circulating faster than any report.

The result? Criminal reports, police custody. I was summoned twice. What I remember most from this violence is the moment when the narrative took precedence over the accounts. You can feel very quickly when confidence has shifted by a single millimeter.

From SMEs to Giants: Same Mechanics, Different Scale

This phenomenon spares no one. Look at Jean-Marie Messier: long the « master of the world, » then associated with the fall of Vivendi.

Today, although he runs a recognized investment bank, the public narrative often remains stuck on the image of the fallen executive. Look at Carlos Ghosn: hero of efficient cost-killing, then a judicial pariah. Depending on whether you read the Japanese or French press, you don’t see the same story. Hero, tyrant, or victim of an industrial conspiracy? The scenarios coexist on the same bedrock of facts.

Conversely, the conflict between Eiffage and Sacyr showed that a file could be extremely tense without turning into a permanent moral soap opera. The tensions were real, but the narrative remained that of a shareholder war, not that of a permanently discredited company.

In all these cases, a core of economic facts serves as a base. But sustainable perception relies on the stories built from them. At the scale of an SME, the mechanics are identical. There are just fewer zeros, and above all, far fewer safety nets.

The Weight of the Past in the Banking File

The narrative is also written in the past. Let’s go back to our regional group. A sale and leaseback operation deemed logical before the crisis turned into heavy litigation, before the matter was finally settled several years later, with an unfavorable outcome for the group, which had to record a significant charge in its accounts.

For an internal financier, it’s rational: the risk is provisioned. But for a banker discovering the file ten years later, it’s a red flag. He doesn’t see an accounting entry; he sees a « heavy problem » with a peer.

« You don’t fight against a number. You fight against what that number suggests. »

Officially, nothing prevented financing new projects. Unofficially, the narrative of a « debtor in conflict » closed doors.

When the Reaction Becomes the Poison

The narrative’s worst enemy is sometimes the leader himself. I’m thinking of another episode where, following a banking error that blocked accounts, management reacted in the heat of the moment with an aggressive email containing threats. Immediate consequence: a lawsuit, police custody, and exposure on social networks.

From that point on, the numbers no longer had a voice. The angry written words composed the narrative: that of an unstable company and an unpredictable leader. Nothing needed to be invented. The leader provided the weapons against his own reputation.

Focus: The Method

OSINT and HUMINT: The Two Faces of Intelligence

A sound economic intelligence approach consists of understanding that two worlds answer each other:

- OSINT (Open Source Intelligence): Everything a third party can learn about you without leaving their screen. Public registries, court decisions, press, forums, customer reviews, old posts.

- HUMINT (Human Intelligence): Field intelligence. Informal conversations, feedback, circulating reputations. The looks that say a lot without ever being written down.

- A company’s image is always built from their combination.

Conclusion: From Guardian of Accounts to Guardian of the Narrative

For a long time, the CFO was reduced to the role of guardian of the accounts. This role remains central, but it is no longer enough. Experience shows that the leader who survives isn’t always the one who is « right » on the facts. It is the one who keeps enough lucidity not to lose control of the story being told about them.

In this lucidity, the CFO occupies a unique place. They see the numbers pass by, but they also hear the signals from the field. Before writing, reacting, or escalating, they must ask this simple question: « If I were a banker, investor, or candidate, what would I think reading this in two years? »

This is not communication. This is governance. And today, it is perhaps one of the most concrete forms of economic intelligence in an SME.

Jérôme Denariez

See also:

- « Guerre de l’Information : Qui contrôle réellement le récit de votre entreprise ? » — (2025-1229)

- « Information Warfare: Who Really Controls Your Company’s Narrative? » — (2025-1229)

- « Informationskrieg: Wer kontrolliert wirklich das Narrativ Ihres Unternehmens? » — (2025-1229)

Decryption: When the Narrative Kills the Balance Sheet

This article shatters a tenacious myth: in 2024, having certified accounts and a profitable model is no longer enough to survive. Jérôme Denariez demonstrates that a « parallel reality » can now destroy a company faster than bankruptcy. This danger is the uncontrolled narrative. Whether it originates on a stock market forum, from a local rumor, or an unfortunate tweet by a CEO, this toxic narrative becomes a very real « liability. »

The author illustrates, through concrete cases (SMEs or giants like Vivendi), how the confidence of bankers and investors shifts not based on figures, but on the story surrounding them. A rational accounting provision becomes a « major problem » as soon as the external narrative labels it as such. Modern governance must therefore no longer just audit the numbers (the Hard data) but obsessively monitor OSINT and weak signals (the Soft data). The CFO is no longer just the guardian of the accounting temple; they must become the guardian of reputation, as it is reputation that now validates financial value.

🔮 And Tomorrow? Two Windows into the Future

The Era of « Narrative Due Diligence »: Tomorrow, auditors will not only verify balance sheets. We will see the emergence of « narrative resilience » audits. Before an acquisition or a loan, algorithms will evaluate whether a company’s digital history is « solid » or if it is vulnerable to the first informational attack. The « Narrative » will become a valuable line item on the intangible balance sheet.

The Generative AI Attack: While the article discusses human rumors, the next step is industrial. Competitors or activists will be able to use AI to generate thousands of coherent narrative « proofs » (fake reviews, fake blog posts, fake interactions) in a matter of hours. Information warfare will no longer be played solely on defense but will require automated narrative « counter-measures » driven by AI.